FTC disclaimer: This post contains affiliate links and I will be compensated if you make a purchase after clicking on my link.

What is Financial Modelling?

Financial modelling is a decision making tool that forecast a company’s overall financial performance with previous historical data and certain basic assumptions.

It is usually performed in an excel sheet in the form of formulas and calculations; assesses the risks and return profile of financial data crucial for company’s strategic and capital decision-making processes.

How do I start learning financial modeling?

Anybody who wants to start a career in finance need to master this important skill of collecting raw financial data, analyse and forecast with a mathematical model and derive a insightful meaning out if it.

Also, financial modeling skills are very much needed in every financial services industry and domains such as investment banks, equity research firms, credit rating, corporate finance, mergers and acquisitions, etc.

Since you will be mostly dealing with numbers in the form of spreadsheet, advance knowledge in excel comes near handy when doing financial analysis of any sort.

You should also have fundamental knowledge about fundamental analysis, equity valuation and what financial planning is all about in general.

Get yourself enrolled to online courses or training programs that teach how to do financial models inside out with hands-on experience.

We have listed the best financial modelling courses based on cost flexibility, reviews and feedbacks.

6 Best Online Financial Modeling Courses – Most Popular Choices

- Business and Financial Modelling Specialization – Coursera

- Beginner to Pro in Excel: Financial Modelling and Valuation – Udemy

- Financial modelling: Build a Complete DCF Valuation Model – Udemy

- Excel Skills for Business Specialization – Coursera

- Introduction to Financial Modeling for Beginners – Udemy

- Financial Modeling for Startups and small Businesses – Udemy

1) Business and Financial Modelling Specialization – Coursera

Coursera, a popular MOOC platform has teamed up with Wharton school of business to bring a highly popular financial modelling specialization.

The specialization has a total of 5 coursers with it and extensively covers the fundamentals and entire process of building and analysing financial models.

If you are new to Coursera, sign up with their 7 days free trial option.

If you are an old user, then audit the course for free to get access to course videos and readings without the quizzes and graded assignments.

All the Coursera specializations work on a monthly subscription basis.

You can either complete the entire specialization in the course order or pick and choose a particular course to master a certain concept.

If you want to earn a certificate of completion for this specialization, you have to complete the entire course including the capstone project along with the individual projects and peer graded assignments.

Course Specialization Duration: 2 months

Skills Gained: Financial Modeling, Microsoft Excel, Simulation and Linear Programming (LP)

Key learning’s from the Specialization:

- Fundamentals of quantitative models and how to build for your own business or enterprise

- How to use MS Excel or spreadsheets for data analysis

- How to create quantitative models to reflect complex realities and how to include risk and uncertainty factors.

- How to use quantitative models to convert the raw financial data into better business decisions

- Use decision making tools to determine the best solution for your business or enterprise

Course 1: Fundamentals of Quantitative Modeling

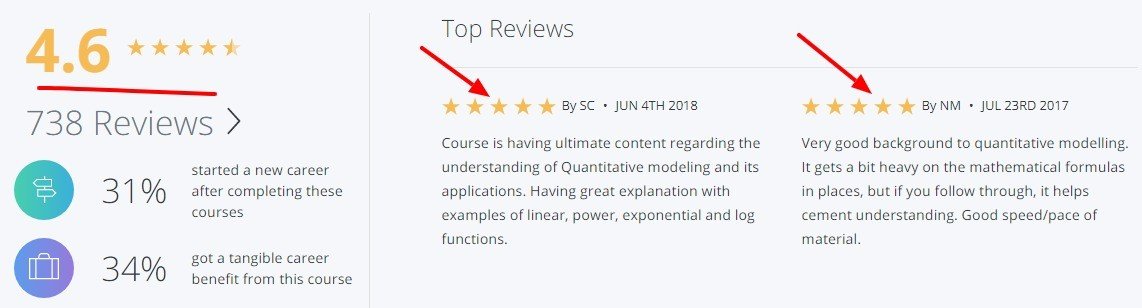

Course ratings: 4.6+ from 3,722+ students; Already Enrolled: 80,853

Course 2: Introduction to Spreadsheets and Models

Course ratings: 4.2+ from 2,044+ students; Already Enrolled: 61,235

Course 3: Modeling Risk and Realities

Course ratings: 4.6+ from 1,370+ students; Already Enrolled: 28,963

Course 4: Decision-Making and Scenarios

Course ratings: 4.6+ from 1,050+ students; Already Enrolled: 24,226

Course 5: Wharton Business and Financial Modeling Capstone

Course ratings: 4.6+ from 307+ students; Already Enrolled: 2,998

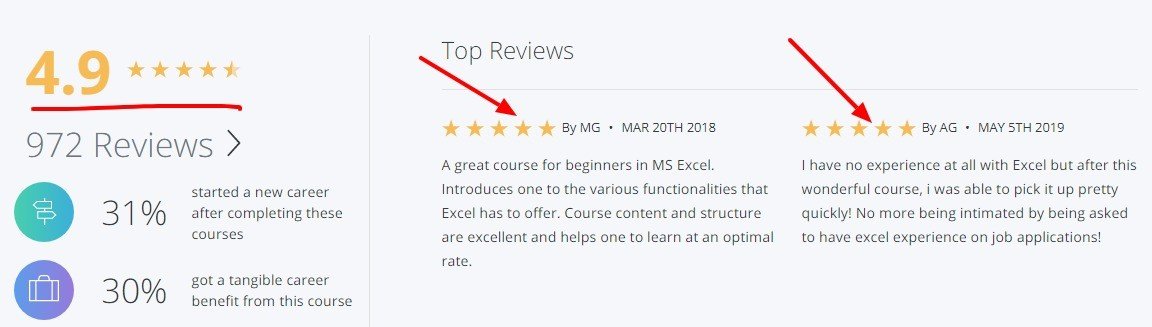

Financial Modeling Course Reviews:

2) Beginner to Pro in Excel: Financial Modelling and Valuation – Udemy

This is one of the best financial modeling course you can find at Udemy to improve your excel and modelling skills.

The course comes with 30 days money back guarantee, lifetime access to the course materials, numerous downloadable resources for future reference and certificate of completion.

Also, the course has received consistently high ratings with huge enrollment numbers.

You can check their feedback sections to know more about what student’s say about the course.

Course ratings: 4.5+ from 12,810+ students

Already Enrolled: 71,525

Skills Gained: MS Excel, Financial modelling, Company Valuation

Key learning’s from the Course:

- Learn MS Excel advance features and become an expert in performing Excel tasks efficiently

- Know how to build cash flow statements, profit and loss statements and build valuation model from raw financial data

- Create financial models for multiple scenarios

- Learn to design professional and good looking advanced charts

Course Reviews:

3) Financial modelling: Build a Complete DCF Valuation Model – Udemy

If you are particularly looking to deepen your knowledge on DCF valuation for financial modelling apart from excel modelling skills, this course is worth checking at Udemy.

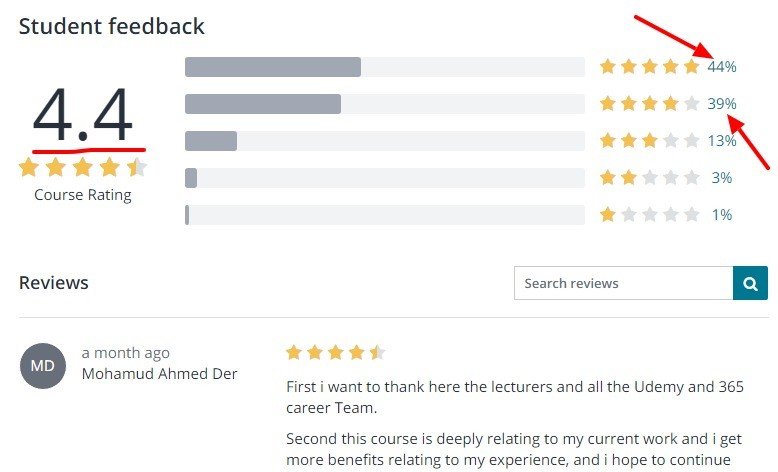

Course ratings: 4.4+ from 1,071+ students

Already Enrolled: 7,485

Skills Gained: Company Valuation and DCF model

Key learning’s from the Course:

- Introduction to company valuation

- The technical tools required for performing company valuation

- Introduction to DCF model and how to build one in Excel

- How to forecast P&L and balance sheet statements and create clean output sheets

- Calculation of Unlevered free cash flows and net cash flows

- Calculation of present value of cash flows within forecast period

- Calculation of continuing value, enterprise value and equity value of business

- Additional analysis that accompanies DCF valuation

- Valuation of Tesla for a hands on experience

Course Reviews:

4) Excel Skills for Business Specialization – Coursera

This is a highly popular specialization at Coursera if you want a thorough knowledge of using Excel for data analysis and data validation.

There are a total of 4 courses in this specialization and if you want a certificate at the end; you have to complete all the 4 courses with assignment and projects.

To do that, you have to opt for a monthly subscription with Coursera.

If you want to learn for free, then you can audit individual courses.

Course Specialization Duration: 3 months

Skills Gained: Data Validation, Microsoft Excel, Microsoft Excel Macro and Pivot Table

Key learning’s from the Specialization:

- Learn to expertly navigate Excel user interface, perform basic calculations with formulas and functions, professionally format spreadsheets and create data visualization using charts and graphs

- How to use advance Excel skills to manage large datasets and create meaningful reports

- Create powerful automations in spreadsheets; create spreadsheets that contains advanced formulas and conditional logic; that help forecast and model data

- Become a power user of Excel and know how to use advanced formula techniques and sophisticated lookups

- Learn how to work with dates and financial functions

- Build professional dashboards in Excel

Course Details:

Course 1: Excel Skills For Business: Essentials

Course ratings: 4.9+ from 3,947+ students; Already Enrolled: 67,722

Course 2: Excel Skills for Business: Intermediate I

Course ratings: 4.9+ from 1,771+ students; Already Enrolled: 29,808

Course 3: Excel Skills for Business: Intermediate II

Course ratings: 4.8+ from 859+ students; Already Enrolled: 16,026

Course 4: Excel Skills for Business: Advanced

Course ratings: 4.7+ from 526+ students; Already Enrolled: 16,441

Financial Modeling Course Reviews:

5) Introduction to Financial Modeling for Beginners – Udemy

This course is especially for those who want to learn financial modeling basics without getting involved into too many complexities.

Course ratings: 4.4+ from 678+ students

Already Enrolled: 13,495

Skills Gained:

Key learning’s from the Course:

- Introduction to important finance and accounting principles

- Learn basic excel features and techniques

- Learn how to build 3 important financial models in Excel: Forecasting, Reporting and Decision-Making Model

- In-depth understanding of business process of lemonade

- Understand how financial modeling process works in a company

- Essential of financial modelling and its usage in Excel sheets

Course Reviews:

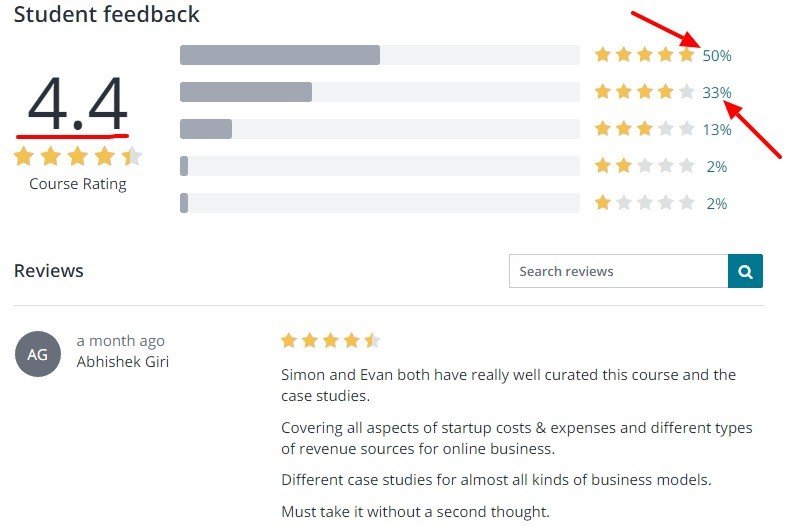

6) Financial Modeling for Start-ups and small Businesses – Udemy

If you want to learn financial modelling for your own online business or startup company; this Udemy course would teach you exactly the same with case studies and taking into account various business models.

Course ratings: 4.4+ from 1,402+ students

Already Enrolled: 48,472

Skills Gained:

Key learning’s from the Course:

- Learn how to build financial models for your start-up business with a handful of case studies

- Modeling various business models for various fields such as technology, brick and mortar, etc

- Forecast different modelling strategies for: cash needs, user growth, revenue, expenses and attrition

- Learn the best practices involved in building practical financial models

Course Reviews:

Let us know in the comments sections what are your best online financial modelling courses for learning?